Some banks are more important than others

If global systematically important banks (G-SIBs) are in trouble, there are repercussions on the whole financial system. These banks are subjected to special rules.

What are G-SIBs?

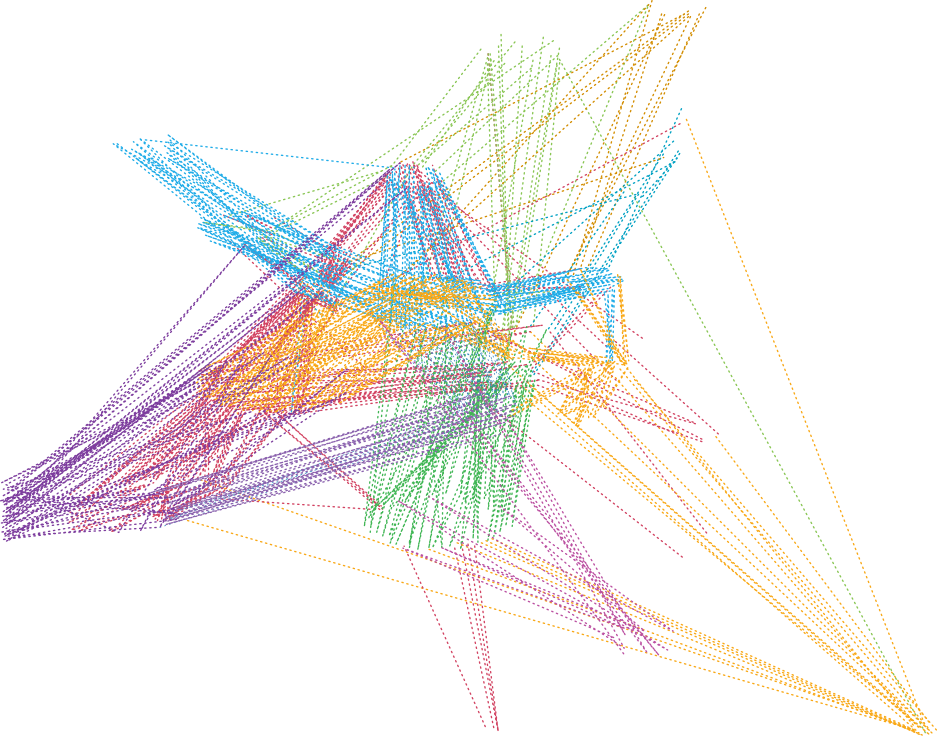

Global systematically important banks (G-SIBs) are financial institutions whose distress or disorderly failure, because of their size, complexity and systemic interconnectedness, would cause significant disruption to the wider financial system and economic activity.

Compared to other banks, G-SIBs must maintain a higher capital level — a capital surcharge.

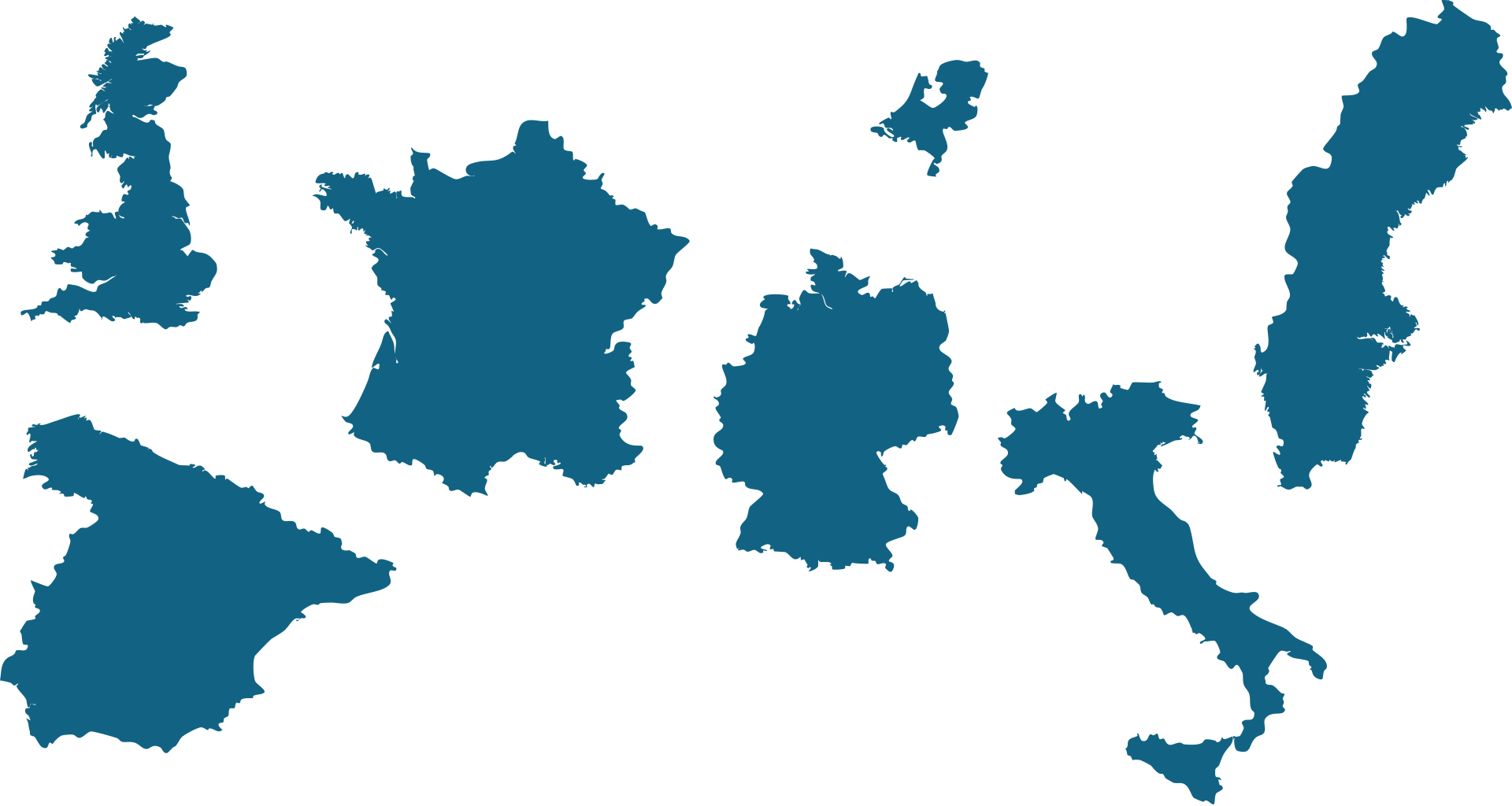

In 2014, 31 G-SIBs were operating worldwide. Among them, 14 were based in the EU.

These 14 G-SIBs represent roughly 40 % of EU-28’s aggregate total assets.

The single rulebook aims to provide a single set of harmonised prudential rules that institutions throughout the EU must respect.

The single rulebook aims to provide a single set of harmonised prudential rules that institutions throughout the EU must respect.

Bank capital

Bank capital

Risk-weighted assets

Risk-weighted assets

Bank assets

Bank assets

Twitter: @EU_scienceHub

Twitter: @EU_scienceHub

LinkedIn: european-commission-joint-research-centre

LinkedIn: european-commission-joint-research-centre

Youtube: JRC Audiovisual

Youtube: JRC Audiovisual

Vimeo: Science@EC

Vimeo: Science@EC